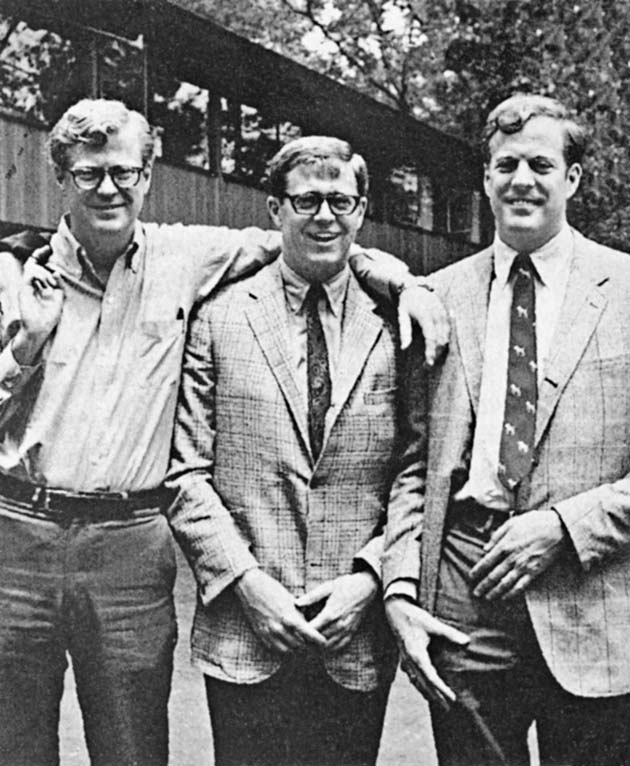

Koch Industries today is a diversified company that is involved in oil/gas refining, paper products, technology, even has their own private investment group to evaluate providing capital to companies. Many people may not know but Koch Industries was actually in the car dealership business back in the 1970's. Chrysler back in the late 1970's decided that it wanted to sell Chrysler Realty Corporation. As part of the Koch vs. Koch lawsuit the Chrysler deal is mentioned in the testimony and the summary can be found here. (The photo above is Bill Koch, Charles Koch, and David Koch).

In September 1979 Koch Industries and George Ablah a land developer from Wichita, Kansas formed a partnership called ABKO. George Ablah who was known as a real estate magnate in the Wichita area and known for constructing shopping malls and developing commercial real estate. George knew Charles Koch (who at that time was only 43 years old) and ABKO Realty was structured to be 50% /50% deal between Ablah and Koch Industries. The name came from from the first two letters of Ablah and well the KO came from a well known oil and company. Charles Koch is known to be a good negotiator and it was even commented that he will negotiate the hyphen in a 50-50 deal. One of the reasons for using the name was a named that could be used in all 50 states. According to Ablah the purpose of the deal was "an opportunity in our eyes to accumulate a lot of real estate in one purchase, and use it as a base to grow". The concept of ABKO was to sell the dealerships that they purchased from Chrysler realty, reduce the overall debt, and then attempt to diversify out of the real estate holdings. ABKO would establish a grade for each property purchased and rate the properties between a grade of A-D to decide which properties to sell and which properties to keep.Actually George was able to start his real estate career when he used the name of Fred Koch of a reference on a bank loan. Charles Koch would refer to Ablah as the second best business partner he ever had (the first was his wife).

The ABKO partnership would allow Koch Industries and George Ablah to purchase Chrysler Realty stock for a cash price of $70 million (after credits) in September 1979. In the late 1970's Chrysler owned 4,730 dealerships throughout the United States and by Chrysler Realty in 1978 earned about $13 million. However by 1979 the Chrysler was in financial trouble and on the verge of bankruptcy needed a $1 billion from the U.S. federal government. What Koch purchased was 556 Chrysler dealerships and 245 leased Chrysler dealerships. The $70 million deal was financed mostly with debt as Koch contributed only $7 million and the remainder of the monies were financed either by Koch Industries financing or from money borrowed from The First National Bank of Chicago. George Ablah personally guaranteed $29 million of the loan in the deal.

ABKO would trade 26 Chrysler dealerships for an office building called "Blue Hill". Blue Hill was an office building in New York that only had a occupancy rate of 19% (typically buildings with an occupancy rate of less than 80% are in trouble). The swap for the Blue Hill office building was roughly $25 million. Blue Hill later would be sold by George Ablah in June 1985 for $100 million. Ablah took on more debt from First Chicago and Chemical bank to make massive capital improvements into Blue Hill and increased the occupancy level to the highest it had ever been. Selling Blue Hill would give Ablah a net gain of $29 million. Taking on debt would catch up to George though. In 1992 George and his wife would file for bankruptcy after changes in federal and state tax rules in the 1980's and early 1990's.

By year end 1981 ABKO was showing results. The entity was able to sell 250 dealerships and realized an after tax income of $34 million ($28 million was paid out as a dividend) and paid down a large portion of the debt owed. Realizing that the economic situation had improved by 1981 Chrysler was interested in repurchasing some of the dealerships owned by ABKO. In 1982 Chrysler and ABKO negotiated a purchase price of $119 million. By this time there were 521 dealerships remaining and Chrysler would purchase 336 of the remaining dealerships from ABKO and sign a 15 year lease on 110 dealerships. The rental income that was generated from the 110 properties had been $11.5 million . The early 1980's were good to Koch Industries. Koch Industries in 1981 had roughly $17 billion in revenue and earn $309 million (a 20% increase from the prior year in earnings). In 1982 Koch Industries would have $309 million in net earnings.

However, by April 1982 George Ablah was getting worried about the future of ABKO due to the controversy between Koch Industries and the lawsuit between the Koch brothers. Ablah in a 7 page memo felt it was hard to do any type of future planning for ABKO due to the lawsuit (he even mentioned he believed he didn't believe William Koch and the other dissenter shareholders liked him). It was at this point that a split up between Koch Industries and ABKO would occur

On September 20, 1982 Ablah and Charles Koch met to discuss the liquidation of ABKO. It was believed that the after-tax value of the company would be worth $90 million (remember the purchase was $70 million). In addition to this, Blue Hill would be worth another $26 million. These of course were preliminary talks and estimates. Charles felt the Ablah should stay until most of the properties had been sold. Also Charles felt it was too early to come to a final agreement since he felt the evaluation of ABKO wasn't complete. By October 1982 (this would be the month Bill Koch and other dissenter shareholders would file a lawsuit) Koch had finalized a proposed transaction and bought out George Ablah's 50% interest in ABKO for $45 million.

The analysis of the possible deal was completed in early October and then proposed at the October 19, 1982 board of meeting. Koch board of directors meeting included Charles Koch, David Koch, Sterling Varner, and Howard Marshall III. A 30 page executive report was created that outlined the proposal, the history of ABKO, and other pertinent financial information. When taking into account the present value of the properties the executive committee report came up with a value between $84-$89 million. The deal would have Koch Industries purchase Ablah's 50% interest in ABKO for roughly $45 million. In last minute revisions of the deal Koch would give Ablah two airplanes (a Lear and Citation jet debt free-however this would reduce the cash he would receive).

The Koch Industries board approved the deal November 6, 1982 (this would be a Saturday-in this Wichita Eagle article it is discussed how Koch Industries executives were expected would work all day Saturday-even into Saturday night). During that Saturday meeting William Koch would testify that the calculations and the outcome of the ABKO deal weren't obvious from the report provided from the 30 page executive report). William would end up retaining evidence of what Koch Industries was doing by keeping files on meeting notes, exploration maps, and files on 37 different subject matters.William asked older brother Charles what the future plans were and Charles responded that there were no final plans and they would probably sell the "bad" properties and keep the good properties for the income stream and continue to evaluate in the future.

Between 1982-1985 with the economy improving Chrysler was also improving and Chrysler was more interested in the remaining dealerships increased. The stock price of Chrysler increased from $11/share in 1982 to $37/share in 1985. Between 1982-1983 Koch would sell 30 more dealership properties for $30 million. For the 1Q 1983 ABKO (which was under Koch Properties) had annualized cash flow of $2 billion. By early 1984 Koch believed that the remaining properties should be sold for an amount equal to what Koch Industries could earn on other investments (Koch believed this was 8%/after taxes/after debt). In October 1985 Chrysler agreed to purchase 56 properties from ABKO for $110 million (Koch believed the properties were worth $98 million (based on report shown to the Koch Industries board of directors) so asked for $135 million). The $110 million was paid to Koch over a 10 year period using a long term note paying 12%.

This case study is a great example of how Koch Industries evaluates their deal making process. Honestly it was shocking to me how much little equity Koch had in the ABKO deal. Koch's capital contributions were only $7 million out a $70 million deal. $63 million of the deal was either financed by Koch Industries or by banks. The deal overall turned out to be good for Koch Industries and George Ablah. Koch purchased Chrysler Realty stock for $70 million in 1979 and then sold properties over time earning $34 million in after-tax profits in 1982, sold properties for $30 million between 1982-1983 and then selling the remainder of the properties for $110 million in 1985. It is hard to know exactly how much money was made on the deal however it is clear that Koch Industries and George Ablah clearly did well on the ABKO deal.

On September 20, 1982 Ablah and Charles Koch met to discuss the liquidation of ABKO. It was believed that the after-tax value of the company would be worth $90 million (remember the purchase was $70 million). In addition to this, Blue Hill would be worth another $26 million. These of course were preliminary talks and estimates. Charles felt the Ablah should stay until most of the properties had been sold. Also Charles felt it was too early to come to a final agreement since he felt the evaluation of ABKO wasn't complete. By October 1982 (this would be the month Bill Koch and other dissenter shareholders would file a lawsuit) Koch had finalized a proposed transaction and bought out George Ablah's 50% interest in ABKO for $45 million.

The analysis of the possible deal was completed in early October and then proposed at the October 19, 1982 board of meeting. Koch board of directors meeting included Charles Koch, David Koch, Sterling Varner, and Howard Marshall III. A 30 page executive report was created that outlined the proposal, the history of ABKO, and other pertinent financial information. When taking into account the present value of the properties the executive committee report came up with a value between $84-$89 million. The deal would have Koch Industries purchase Ablah's 50% interest in ABKO for roughly $45 million. In last minute revisions of the deal Koch would give Ablah two airplanes (a Lear and Citation jet debt free-however this would reduce the cash he would receive).

The Koch Industries board approved the deal November 6, 1982 (this would be a Saturday-in this Wichita Eagle article it is discussed how Koch Industries executives were expected would work all day Saturday-even into Saturday night). During that Saturday meeting William Koch would testify that the calculations and the outcome of the ABKO deal weren't obvious from the report provided from the 30 page executive report). William would end up retaining evidence of what Koch Industries was doing by keeping files on meeting notes, exploration maps, and files on 37 different subject matters.William asked older brother Charles what the future plans were and Charles responded that there were no final plans and they would probably sell the "bad" properties and keep the good properties for the income stream and continue to evaluate in the future.

Between 1982-1985 with the economy improving Chrysler was also improving and Chrysler was more interested in the remaining dealerships increased. The stock price of Chrysler increased from $11/share in 1982 to $37/share in 1985. Between 1982-1983 Koch would sell 30 more dealership properties for $30 million. For the 1Q 1983 ABKO (which was under Koch Properties) had annualized cash flow of $2 billion. By early 1984 Koch believed that the remaining properties should be sold for an amount equal to what Koch Industries could earn on other investments (Koch believed this was 8%/after taxes/after debt). In October 1985 Chrysler agreed to purchase 56 properties from ABKO for $110 million (Koch believed the properties were worth $98 million (based on report shown to the Koch Industries board of directors) so asked for $135 million). The $110 million was paid to Koch over a 10 year period using a long term note paying 12%.

This case study is a great example of how Koch Industries evaluates their deal making process. Honestly it was shocking to me how much little equity Koch had in the ABKO deal. Koch's capital contributions were only $7 million out a $70 million deal. $63 million of the deal was either financed by Koch Industries or by banks. The deal overall turned out to be good for Koch Industries and George Ablah. Koch purchased Chrysler Realty stock for $70 million in 1979 and then sold properties over time earning $34 million in after-tax profits in 1982, sold properties for $30 million between 1982-1983 and then selling the remainder of the properties for $110 million in 1985. It is hard to know exactly how much money was made on the deal however it is clear that Koch Industries and George Ablah clearly did well on the ABKO deal.

No comments:

Post a Comment