For many years I have followed Koch Industries and covered the growth in net worth of both Charles and David Koch here, the Koch Industries dividend policy here, and mostly the dividend policy here. For years I know that Forbes kept track of private companies and their revenues however it is not easy to access and download that information for each company going back to 1984. Luckily I was able to access a local university library that has a subscription to news bank which contains historical articles. Oftentimes years ago Forbes would publish the largest companies in the country and other outlets would pick up the story like UPI, the Detroit Free Press, and The Wichita Eagle.

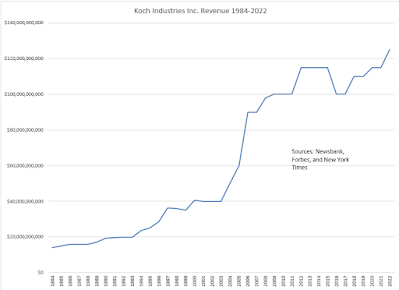

Koch Industries has a policy to try to reinvest 90% of these companies earnings back into the company period since Koch is privately held it can reinvest that much back into the company. Back in 1984 Koch Industries only had revenue of $14 billion and recently in 2022 the revenue grew to roughly $125 billion. This would say that over a 39 year period the revenue has increased at a compounded rate of 6% per year. However, if you break out the different time periods you see that revenue growth has been stronger recently than in the past. For example, if you analyze the growth rate from 1984 to 1994 you would get roughly a 5.4% compounded growth per year. From 1994 to 2004 Koch Industries increased revenue by a compounded amount of 7.7% per year. However from 2004 to 2014 Koch Industries was able to increase the revenue growth by a compounded 9.56% per year. One of the largest growth engines for Koch Industries was their acquisition of Georgia Pacific which I discussed here. The revenue before the acquisition for Koch was $60 billion and one year later in 2006 jumped to $90 billion (Charles Koch had estimated revenue would be $80 billion after the merger). The addition of Georgia Pacific would increase Koch Industries revenues by 50%.

Today Koch Industries has evolved from when Charles Koch began working at the firm in the 1960s and the company primarily was in refining and the crude oil gathering business. Today Koch Industries makes equity investments, glass, toilet paper, paper towels, cloud software, refining, fertilizer, transportation, shipping, transportation, electronic connectors, and the list goes on and on.

Even though Charles Koch is in his twilight years and currently is in his mid 80s he's still pushing hard to try to continue to keep things moving at Koch Industries. It is clear that Charles Koch and his brother David Koch worked very hard to make the company grow over many decades. In the late 1990s there was an article describing how Charles would work 12 hours a day and then go home to work even more, and also he would work on the weekends. When Charles was younger in his career he would have executives come in Saturday mornings to the office (no working from home back then) and sometimes Charles would call a meeting that would run into Saturday evening! According to Kochland Charles would sometimes on Sunday afternoon call employees and ask them to come into the office for a meeting. You can't grow a company by working Monday to Friday 9:00 AM to 5:00 PM. The hard work has resulted in Koch Industries continually growing as they reinvest 90% of their earnings back into the company and the historical growth rate of the revenue has proven this out.

No comments:

Post a Comment